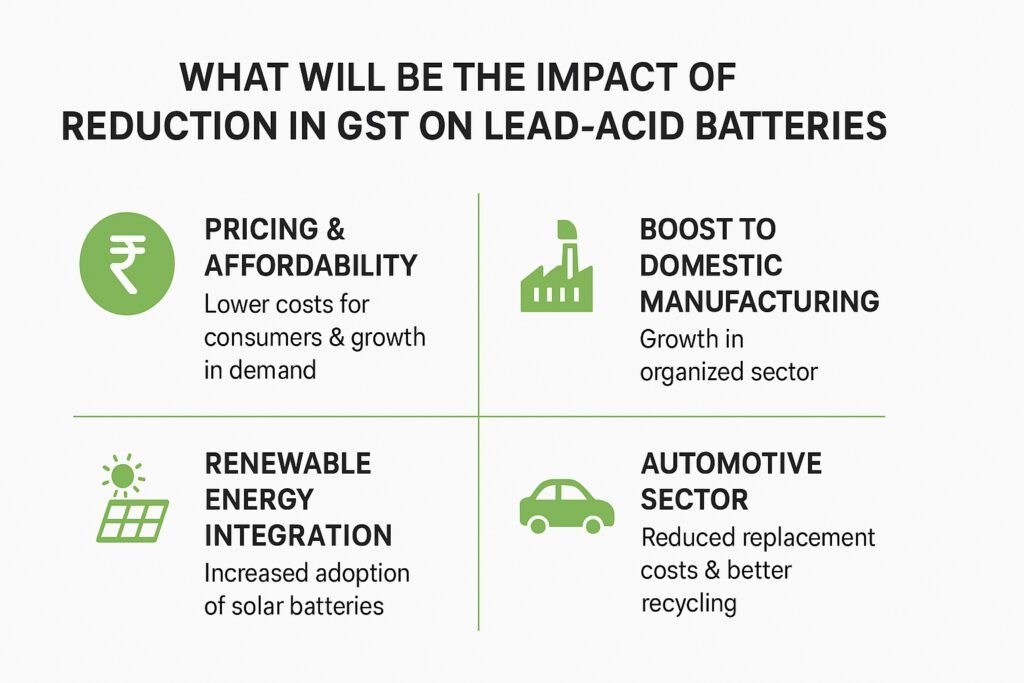

The lead-acid battery industry in India has long been an integral part of sectors ranging from automotive to renewable energy backup systems. With its cost-effectiveness, reliability, and recyclability, the lead-acid battery remains a backbone of energy storage despite the rising popularity of lithium-ion alternatives. Recently, discussions and proposals around reducing the Goods and Services Tax (GST) on lead-acid batteries have gained momentum. If implemented, this move could significantly impact manufacturers, distributors, and consumers. Let’s explore the implications of a GST reduction in detail.

Current GST Scenario for Lead-Acid Batteries

At present, lead-acid batteries attract a GST rate of 28% in India, one of the higher tax slabs under the regime. This high tax rate has been a concern for manufacturers and end-users, especially when compared to lithium-ion batteries, which benefit from incentives under the government’s push for electric mobility and renewable integration.

A reduction in GST — whether to 18% or even lower — would change the dynamics of the lead-acid battery market drastically.

Impact on Pricing and Affordability

The most immediate effect of GST reduction will be lower prices for consumers. Lead-acid batteries are widely used in:

-

Automobiles (two-wheelers, cars, trucks, tractors)

-

Inverters and UPS systems

-

Telecom towers and data centers

-

Solar energy storage solutions

With lower GST, the upfront cost of batteries will decline, making them more accessible to households, small businesses, and industries. This affordability can boost demand, particularly in rural and semi-urban areas where inverters and solar applications are essential due to power reliability issues.

Boost to Domestic Manufacturing

India has a strong base of lead-acid battery manufacturers, both organized players (like Exide, Amara Raja, Luminous) and unorganized small-scale producers. A GST reduction will encourage domestic manufacturing growth by:

-

Reducing overall cost of production

-

Improving competitiveness against imported alternatives

-

Enabling companies to expand their distribution networks

This aligns well with the government’s “Make in India” initiative and can generate more employment opportunities in the energy storage sector.

Encouragement for Renewable Energy Integration

While lithium-ion batteries are often hailed as the future of renewable integration, lead-acid batteries still hold a dominant market share in solar home systems and small-scale renewable projects due to their lower upfront costs.

A lower GST would:

-

Increase solar battery adoption in households and small businesses

-

Make hybrid solar-inverter systems more affordable

-

Support India’s push for decentralized renewable energy

This would contribute directly to achieving India’s renewable energy targets by 2030.

Positive Impact on Automotive Sector

The automotive sector remains the largest consumer of lead-acid batteries. Whether it is starting, lighting, and ignition (SLI) batteries for vehicles or auxiliary batteries for electric rickshaws, affordability is key. A GST cut will:

-

Lower replacement costs for vehicle owners

-

Benefit fleet operators and logistics companies

-

Support small-scale e-rickshaw drivers, enhancing sustainable urban mobility

This ripple effect can also lead to better compliance in battery recycling since consumers will find it more economical to trade in old batteries for new ones.

Growth of Organized Sector and Better Recycling

The lead-acid battery industry has a large unorganized segment, often accused of poor recycling practices that harm the environment. With reduced GST, organized players could offer more competitive pricing, shrinking the gap between formal and informal markets.

This will:

-

Encourage customers to buy from branded, regulated companies

-

Strengthen formal collection and recycling channels

-

Reduce environmental hazards caused by unsafe lead handling

Challenges and Considerations

While the reduction in GST would bring several benefits, there are also challenges:

-

Revenue Loss for Government – Lowering GST will reduce immediate tax collections. However, increased volumes may partly offset this.

-

Lithium vs. Lead-Acid Balance – The government is pushing for lithium-ion adoption in EVs. Cheaper lead-acid may slow the shift unless policies differentiate between sectors.

-

Environmental Concerns – Despite recyclability, lead is hazardous. Any expansion must be accompanied by stricter regulations on recycling and waste management.

Long-Term Outlook

If GST on lead-acid batteries is reduced, the industry can expect:

-

A surge in demand across household, industrial, and automotive segments

-

Strengthened manufacturing ecosystem supporting jobs and local economies

-

Greater contribution to energy security and renewable adoption

-

More organized recycling practices, improving sustainability

This move would not just make energy storage more affordable but also help bridge the gap until advanced technologies like lithium-ion and solid-state batteries become mainstream and economically viable.