India’s battery market is accelerating at an electrifying pace—driven by booming electric mobility, ambitious renewable energy targets, and intensified policy support. Here’s an expansive look at its growth trajectory and untapped potential.

1. Market Growth at a Glance

-

Rapid Expansion of Battery Systems

The Battery Energy Storage System (BESS) market in India was valued at approximately USD 7.8 billion in 2024 and is projected to soar to about USD 32 billion by 2030, at a CAGR of around 27% MarkNtel Advisors. -

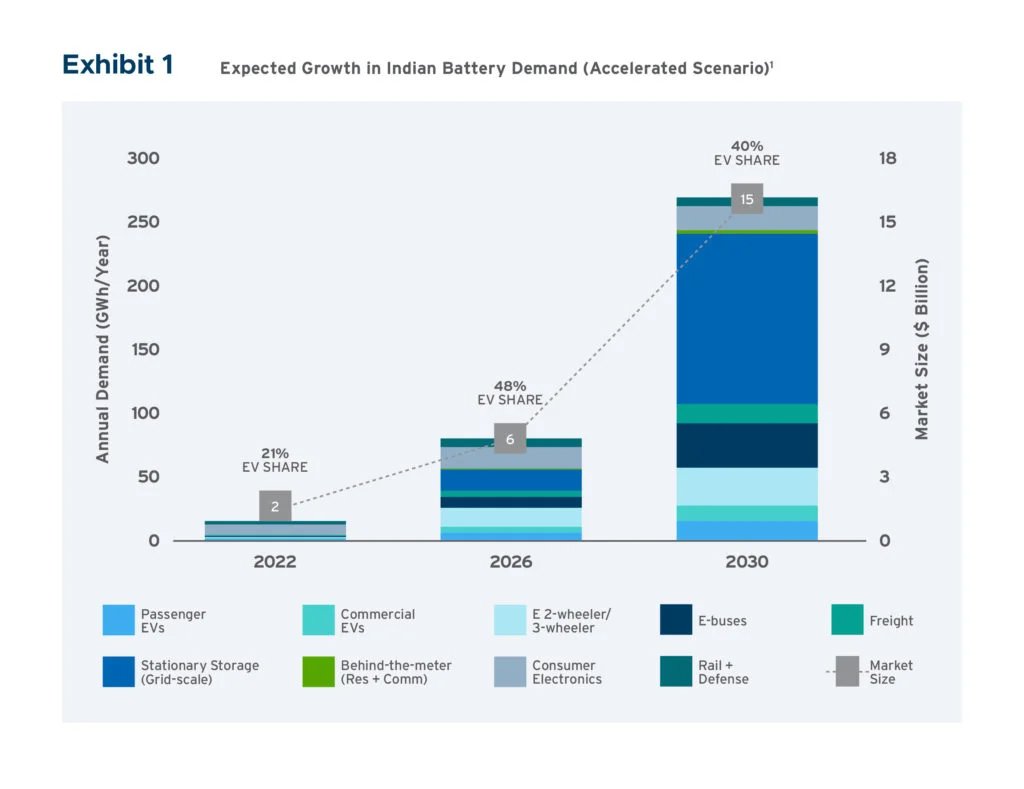

Overall Battery Market Jump

The broader battery market—covering EV batteries and beyond—grew from an estimated USD 6.12 billion in 2023 and is expected to reach USD 18.05 billion by 2030, reflecting a CAGR of 16.5% BlueWeave Consulting. -

EV Battery Segment Growth

India’s EV battery market alone is poised to grow from USD 16.77 billion in 2023 to USD 27.70 billion by 2028, growing at about 10.6% CAGR The Hindu Business Line.

2. Key Growth Drivers

-

Policy and Incentive Boost

Strategic initiatives like the Production Linked Incentive (PLI) program are fueling gigafactory development and domestic battery cell manufacturing. In addition, ISTS transmission charge waivers for BESS projects have been extended through June 2028, with support for up to 30 GWh of battery storage capacity ReutersEQ Magazine. -

Scaling Renewable Energy Integration

With India targeting 500 GW of non-fossil fuel capacity by 2030, battery storage is essential for balancing supply and demand from fluctuating solar and wind generation ReutersSLOT GACOR. -

Industrial Investments and Supply Chain Localization

Major investments are underway—Graphite India announced a ₹4,761 crore project in Nashik to produce synthetic graphite anode materials for lithium-ion batteries, and Haryana recently launched India’s first advanced lithium-ion manufacturing plant, expected to meet 40% of domestic battery demand The Times of IndiaThe Economic Times. -

Strategic Partnerships

Global automakers Hyundai and Kia have signed a pact with India’s Exide Energy to localize LFP cell battery production in India—marking a significant step toward reducing import dependence Reuters. -

Grid Modernization Initiatives

NTPC is piloting battery integration at coal-fired plants to manage solar over-generation, issuing tenders for 1.7 GW of storage capacity to smooth transitions and maintain grid reliability Reuters.

3. Emerging Opportunities

-

Recycling and Second-Life Deployment

India is poised to house a 128 GWh market for recycled EV batteries by 2030. This presents lucrative opportunities in refurbishing and repurposing spent battery modules The Economic TimesSLOT GACOR. -

Addressing Financing Gaps

Despite high demand, financing costs in India remain significantly above global averages—delaying BESS adoption. There’s a clear role for policy reform and innovative funding mechanisms to remove capital barriers EQ Magazine. -

Opportunities for Smart Tech and Exports

Declining costs of EV battery packs—down to $1.67 per kWh in 2023—have catalyzed demand. India’s burgeoning requirement for 139 GWh of EV lithium batteries by 2035 opens doors for exports, advanced BMS solutions, and smart storage integrations Trade.gov.

4. Potential Challenges

-

Risk of Oversupply

SBICAPS forecasts India may add 30 GW of storage capacity by June 2027, raising concerns about potential oversupply—if infrastructure and demand ecosystems don’t scale correspondingly pv magazine India. -

Raw Material Dependency

India remains heavily reliant on imports for lithium and cobalt. With limited domestic reserves, price volatility risks persist. Strengthening mining, refining, and supply chains remains essential SLOT GACOR.

5. Strategic Outlook & Path Forward

| Strategic Focus Area | Action & Potential Impact |

|---|---|

| Scaling Domestic Manufacturing | Stronger local production reduces vulnerability to global supply shocks. |

| End-to-End Value Chain Development | From mining to recycling—building a circular battery economy improves resilience. |

| Policy & Financing Support | Affordable capital and long-term incentives can drive large-scale deployment. |

| Smart Integration & Innovation | AI-enabled BMS, second-life storage, and EV-grid synergies unlock new models. |

| Global Trade & Collaboration | Partnerships and exports can position India as a regional powerhouse. |

Summary

India’s battery market is embarking on a high-growth trajectory—powered by demand from EVs, renewables, grid modernization, and bold industrial policy. With projected values reaching USD 18 billion for the overall market, USD 32 billion for BESS, and USD 28 billion for EV batteries, the horizon is electrifying.

However, sustained progress will depend on smart integration of policy, technology, and financing. If done right, India stands poised not just to meet domestic energy goals—but to emerge as a global leader in battery innovation and clean energy infrastructure.