Batteries play a crucial role in powering multiple sectors of India’s economy—ranging from automobiles and renewable energy storage to inverters, telecom, and industrial applications. However, taxation has always been a significant factor influencing their affordability and adoption. A decrease in the Goods and Services Tax (GST) rate on batteries has far-reaching implications for both manufacturers and consumers. It not only reduces the overall cost of energy storage solutions but also accelerates the growth of industries dependent on them, while promoting India’s transition to sustainable energy.

GST on Batteries: A Background

When GST was implemented in 2017, batteries—particularly lead-acid batteries—were taxed at a higher slab of 28%, placing them in the luxury and sin goods category. This classification was often criticized because batteries are not luxury items; they are necessities in both urban and rural India. Over time, demands from industry associations and renewable energy advocates led to calls for rationalizing GST rates.

A decrease in GST rates—whether on lead-acid, lithium-ion, or other advanced chemistry batteries—would mark a significant shift, bringing them in line with renewable energy components that already enjoy lower tax rates.

Economic Impact

1. Lower Costs for Consumers

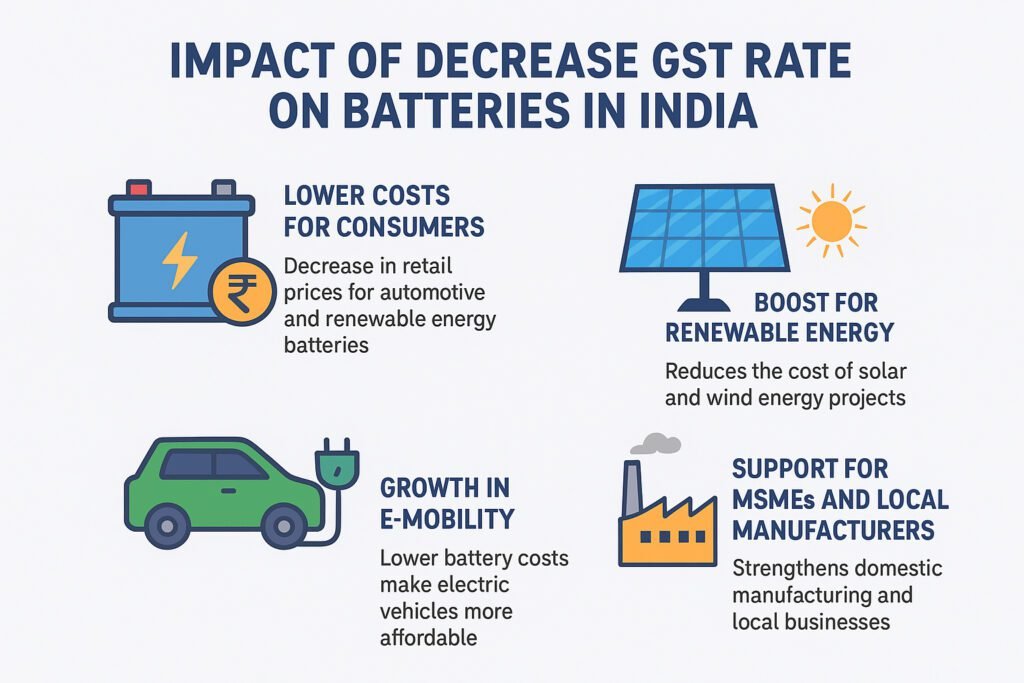

One of the most immediate benefits of a GST rate cut is reduced retail prices. Batteries used in automobiles, e-rickshaws, inverters, and solar storage would become more affordable, directly benefiting households, small businesses, and transport operators. For example, lower battery costs can make electric vehicles (EVs) more accessible to middle-class buyers, accelerating EV adoption.

2. Boost for Renewable Energy Sector

Solar and wind energy projects often rely on storage solutions to ensure reliability. Currently, batteries attract a higher tax rate compared to other renewable components like solar panels (5% GST). Aligning battery GST with solar will reduce project costs, encouraging wider adoption of rooftop solar and off-grid renewable systems. This would support India’s target of achieving 500 GW renewable capacity by 2030.

3. Growth in E-Mobility

The EV revolution in India depends heavily on affordable batteries. With batteries accounting for nearly 40–50% of an EV’s cost, even a small reduction in tax rates can significantly lower vehicle prices. This would benefit not only car buyers but also users of two-wheelers, e-rickshaws, and buses, leading to mass adoption of electric mobility solutions.

4. Support for MSMEs and Local Manufacturers

India’s battery industry, particularly the lead-acid battery segment, includes numerous small and medium enterprises (SMEs). A lower GST burden would ease working capital pressure, enhance competitiveness, and allow local manufacturers to scale production. It may also attract greater investment into domestic lithium-ion battery manufacturing, aligning with the government’s “Atmanirbhar Bharat” mission.

Social & Environmental Impact

1. Enhanced Rural Electrification

In rural India, batteries are widely used in inverters, solar home systems, and e-rickshaws. Lower GST rates would make these solutions more affordable, thereby improving access to reliable electricity and last-mile mobility for rural populations.

2. Promotion of Green Energy

By making battery-powered solutions cheaper, a GST cut aligns taxation with India’s environmental goals. Encouraging battery adoption reduces reliance on diesel generators, minimizes emissions, and promotes sustainable energy consumption.

Challenges & Considerations

While the reduction in GST on batteries offers numerous benefits, certain challenges must also be acknowledged:

-

Revenue Implications for Government: A lower tax rate may reduce short-term GST collections, though it could be offset by higher demand.

-

Environmental Concerns: Increased demand for lead-acid batteries raises questions about safe recycling and disposal. Stronger recycling frameworks will be necessary.

-

Technology Neutrality: Care must be taken to balance incentives across battery chemistries—lead-acid, lithium-ion, and emerging technologies—so that no sector is unfairly disadvantaged.